Consistent pricing, reliable fill ratios and extremely fast and secure trade execution from data centers in New York, London, Tokyo, Singapore and Mexico City

Order flow and resting interest sourced globally (including bank and non-bank market makers, FX platforms and our own customer order book), supporting all trade sizes, time zones and execution methods, and representing the full scope and depth of the global FX liquidity pool

Anonymous trading with credit intermediation via Streaming, RFS and RFQ, connecting global clients with local liquidity

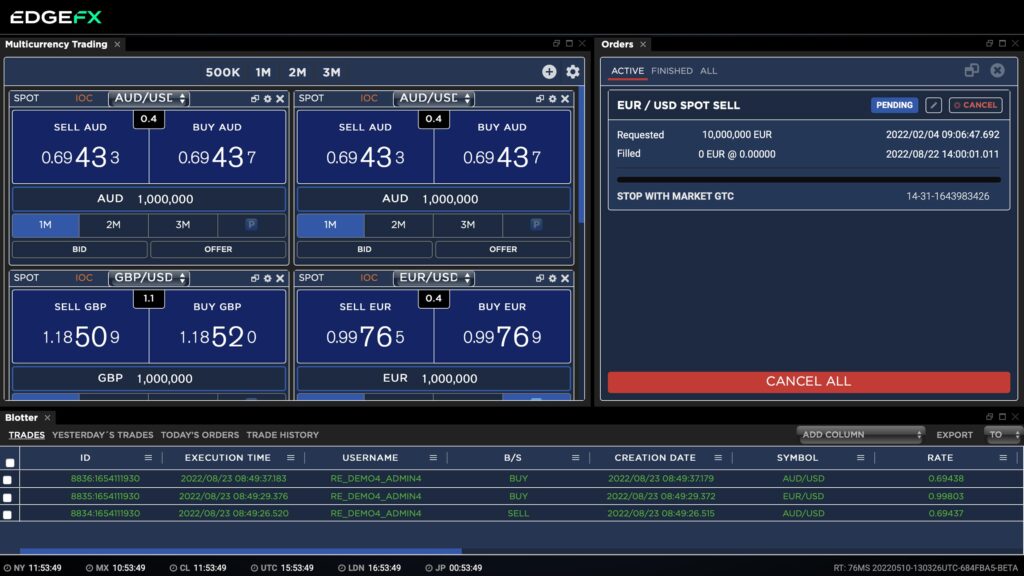

Highly customizable web-based platform (delivered via an intuitive GUI) with secure, permissioned access – and nothing to download

FIX-based API fully integrated with low-latency cross-connections, supporting all FX technology and ECN liquidity platforms

Seamless integration with existing technology systems, reducing operational risk and ensuring efficient order entry and automated trade processing

Everything banks, asset managers, hedge funds, brokers and other financial institutions need to get the most out of our advanced FX trading system

With EdgeFX Custom, our clients can personalize our flagship trading technology with their own brand, workflows and user experience to deliver a truly differentiated FX trading experience to their own customers.